Are you wondering how to choose the right loan for your needs? With so many options out there, picking the best one can feel overwhelming. Whether you’re buying a home or refinancing, it’s essential to understand which loan will give you the best value.

Using a loan comparison calculator by Shore Financial or similar firms can be a game-changer. It offers an easy, convenient way to compare features side by side, ensuring you make an informed decision. Let’s read about its benefits in detail.

Simplifies Your Decision

One of the biggest benefits of a loan comparison calculator is the clarity it provides. This tool helps you avoid being swayed by fancy offers or confusing jargon. With straightforward numbers and data, you can see the pros and cons of each option. The calculator will present side-by-side comparisons of interest rates, monthly repayments, and overall costs, making it easier to weigh each option’s true value.

Assessing Interest Rates Effectively

Interest rates are one of the most important factors in any loan, and they can vary widely between lenders. Even a slight difference in rates can affect the total amount you’ll end up paying. The calculator allows you to examine how different interest rates impact your repayments and overall cost. It’s a powerful way to visualise potential savings from choosing funding at a lower rate.

Understanding Repayment Terms with Ease

Repayment terms influence how long you’ll be paying off your loan and how much you’ll pay in total. Different options come with various terms, from short-term to long-term options. A calculator breaks down these terms in a clear and straightforward way.

You can see how a shorter repayment term might increase monthly payments but reduce total interest costs. Meanwhile, a longer term may offer lower monthly payments but lead to more interest overall.

Estimating Total Loan Costs

Another important factor in choosing a loan is the total cost over the entire term. Many people focus only on monthly repayments, but understanding the overall cost gives a more complete picture. The calculator reveals the cumulative cost of each funding option. This view includes not just the principal and interest but also any fees or hidden costs associated with each funding.

Spotting Additional Fees and Hidden Costs

Fees and hidden charges can make a big difference in the affordability of a loan. Some come with application fees, ongoing monthly fees, or early repayment penalties. The calculator displays these fees alongside the main costs. This transparency enables you to factor these expenses into your decision-making process. A funding that appears cheaper at first glance might be more costly once fees are added.

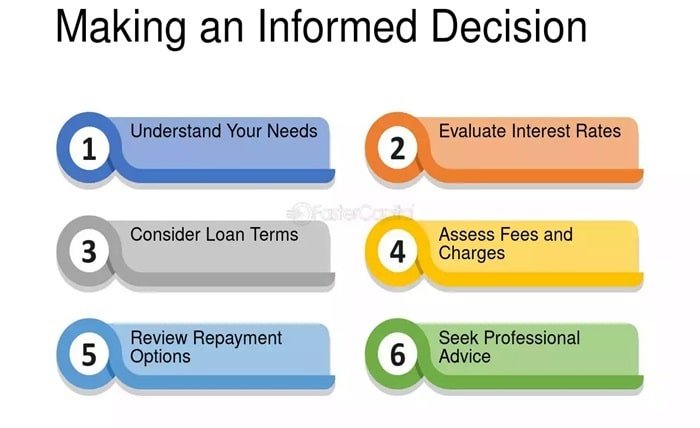

Making an Informed Decision

The best part about using a loan comparison calculator is the confidence it provides. Once you’ve reviewed and compared the different options, you can move forward with peace of mind, knowing you’ve chosen a funding that meets your needs.

This tool saves you time, prevents stress, and enhances your decision-making process. You won’t have to rely on guesswork or marketing promises—you’ll have clear, accurate data to guide your choice.

Visualising Monthly Repayments with Precision

One of the most useful features of a loan comparison calculator is its ability to display monthly repayments for each option. Monthly payments are a crucial consideration for budgeting, and seeing them laid out side by side gives you a clear picture of what you can comfortably afford. This feature helps you avoid overextending your budget and ensures that your monthly payments fit smoothly into your financial plan.

Finding the right loan is all about clarity and preparation. Using a loan comparison calculator by Shore Financial or similar firms simplifies the search, helping you weigh essential factors like interest rates, repayment terms, and fees. Use it wisely, and you’ll be on your way to a secure, stress-free financial future.