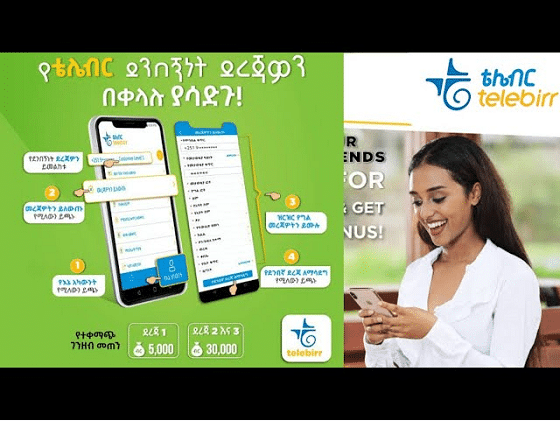

TeleBirr is a digital payment app designed specifically for Ethiopian users to simplify financial transactions. It allows users to pay bills, transfer money, and manage finances directly from their smartphones. In this guide, we’ll walk you through the steps to download and use TeleBirr, explore its features, and answer common questions to help you get started.

What is Tele Birr?

Tale Birr is a mobile application that facilitates cashless payments, fund transfers, and other digital financial services for Ethiopian users. Its user-friendly design and wide range of features make it an ideal tool for anyone looking to manage their finances more conveniently. TeleBirr’s secure and accessible platform is tailored to meet the needs of people from all backgrounds, whether living in urban centers or remote areas.

How to Download the Tele Birr App

Downloading on Android Devices

- Open Google Play Store on your Android device.

- Search for “TeleBirr” in the search bar.

- Once you locate the app, click on ‘Install’ to download it.

- The app will automatically install once downloaded.

Downloading on iOS Devices

- Open the App Store on your iPhone.

- Search for “TeleBirr” in the search bar.

- Select the app from the list of results and tap ‘Get’ to download it.

- Once downloaded, the app will install on your device.

Note: Ensure your device has the latest software update for optimal performance with TeleBirr.

Registering and Setting Up Your Tale Birr Account

After downloading, follow these steps to create your TeleBirr account:

- Open the Tale Birr App: Launch the app by tapping the TeleBirr icon on your home screen.

- Register Your Details: Enter basic details like your phone number, email address, and full name.

- Verify Your Account: A One-Time Password (OTP) will be sent to your phone number for verification. Enter this code to proceed.

- Set a Secure PIN: Choose a secure PIN to protect your account. This PIN will be used for each transaction.

- Complete Profile: Add any additional details as prompted by the app to fully complete your profile.

Your account is now ready to use! Ensure you remember your PIN, as it will be required for secure access.

How to Use Tale Birr: Key Features and Services

Once registered, TaleBirr offers a variety of digital financial services. Here are some of the main features you’ll find in the app:

Making Money Transfers

Tale Birr allows for quick, secure money transfers, both to other TaleBirr users and across banks in Ethiopia.

- How to Send Money:

- Open the “Transfers” section in the app.

- Enter the recipient’s mobile number or account details.

- Enter the amount you wish to transfer.

- Confirm the transaction with your PIN.

- How to Receive Money:

- When someone sends you money, the amount will automatically reflect in your TaleBirr wallet.

- You’ll also receive a notification confirming the deposit.

Paying Bills

TaleBirr makes paying utility bills and other expenses simple and straightforward.

- How to Pay a Bill:

- Go to the “Bill Payments” section.

- Select the type of bill (electricity, water, or telecom) you want to pay.

- Enter your account details as prompted.

- Enter the amount and confirm the transaction using your PIN.

Merchant Payments

You can use Tale Birr to make payments at stores and other outlets that accept digital payments.

- How to Pay Merchants:

- Look for merchants displaying the Tale Birr logo.

- Scan their QR code or enter their business ID in the app.

- Enter the amount to be paid and confirm with your PIN.

Checking Account Balance and Transaction History

Keeping track of your balance and transaction history is easy with TaleBirr.

- How to Check Balance:

- Tap on the “Balance” section to view your current account balance.

- How to View Transaction History:

- Access your past transactions through the “History” tab, which records all payments, transfers, and deposits.

Applying for Microloans

For users needing short-term financial assistance, Tale Birr offers a microloan service.

- How to Apply for a Loan:

- Navigate to the “Loans” section in the app.

- Enter the amount you wish to borrow (within the loan limits set by TaleBirr).

- Submit the application and wait for confirmation.

Note: Loan approvals are subject to verification and may vary depending on user eligibility.

Tale Birr App Features at a Glance

| Feature | Description | Steps to Access |

|---|---|---|

| Money Transfers | Send and receive money quickly | “Transfers” > Enter Details > Confirm |

| Bill Payments | Pay utilities like electricity and water | “Bill Payments” > Select Type > Confirm |

| Merchant Payments | Use at physical and online stores | “Pay Merchant” > Scan QR > Confirm |

| Balance Check | View your current account balance | “Balance” |

| Transaction History | Track all transactions made on Tale Birr | “History” |

| Microloans | Apply for small loans as per eligibility | “Loans” > Apply for Amount |

Benefits of Using Tale Birr

Using Tale Birr provides multiple benefits, including:

- Accessibility: Available to anyone with a smartphone, the app brings digital banking services closer to both urban and rural users.

- Convenience: TaleBirr saves time and energy, allowing you to complete financial transactions from anywhere.

- Affordability: TaleBirr offers competitive rates on transactions, making it affordable for all users.

- Enhanced Security: With a strong PIN and OTP verification system, TaleBirr ensures each transaction is secure.

Common Issues and Troubleshooting

Here are some common issues you may encounter while using TaleBirr and their solutions:

- Forgot PIN: Use the “Forgot PIN” option to reset it via OTP.

- Network Issues: If you’re experiencing connection problems, ensure a stable network connection or switch to Wi-Fi if available.

- Verification Issues: If OTP verification fails, re-enter your number correctly and request a new OTP.

Frequently Asked Questions (FAQ)

1. Is Tale Birr safe to use?

Yes, Tale Birr uses encryption, PIN protection, and OTP verification to ensure the safety of user data and transactions.

2. Can I use Tale Birr without a bank account?

Yes, TaleBirr can be used with just a mobile device. You can add funds through authorized agents if you don’t have a bank account.

3. Are there any fees for transactions on TaleBirr?

Tale Birr has minimal transaction fees, which vary depending on the type of transaction.

4. What if I lose my phone?

If you lose your phone, contact TaleBirr support to secure your account and prevent unauthorized access.

5. Can I use Tale Birr outside of Ethiopia?

Tale Birr is intended for use within Ethiopia; transactions outside the country may not be supported.

6. How can I check my account balance?

You can check your balance through the “Balance” section on the app’s main page.

7. Is customer support available?

Yes, TaleBirr offers customer support to assist users with any issues or questions.

Conclusion: Simplifying Finances with Tale Birr

Tale Birr is revolutionizing digital payments in Ethiopia, bringing financial services to more people through its accessible mobile platform. With a few taps, users can transfer money, pay bills, and even apply for microloans without needing to visit a bank. Tale Birr’s security features, affordability, and convenience make it an ideal choice for anyone looking to manage finances digitally in Ethiopia.

Whether you’re a new user or already using The app, understanding the app’s features and functionalities can help you get the most out of it. Embrace the ease of cashless payments and secure transactions with TaleBirr as you contribute to Ethiopia’s growing digital economy.